Applied Macroeconometrics

Course ID:

Semester: 1st

Year of Study: 1st Year

Category: Compulsory

For Erasmus Students: Όχι

Learning Outcomes

Upon successful completion of the course the student will be able to:

- understand some of the pitfalls, problems, and solutions that arise in applied macroeconomic work

- Critically evaluate applied macro-econometric research

- be familiar with the main approaches to modelling macroeconomic data

- understand the formal and practical aspects of important macro-econometric methods.

- apply analytical methods and recognize their limitations, solve problems associated with identification using macroeconomic data

- be able to report empirical research results obtained using the methods covered.

- perform analyses with macroeconomic data using gretl and R and to interpret gretl output as well as output in R

- be able to replicate and present macroeconomic research papers that will enhance their ability to write an advanced high-quality dissertation

Course Contents

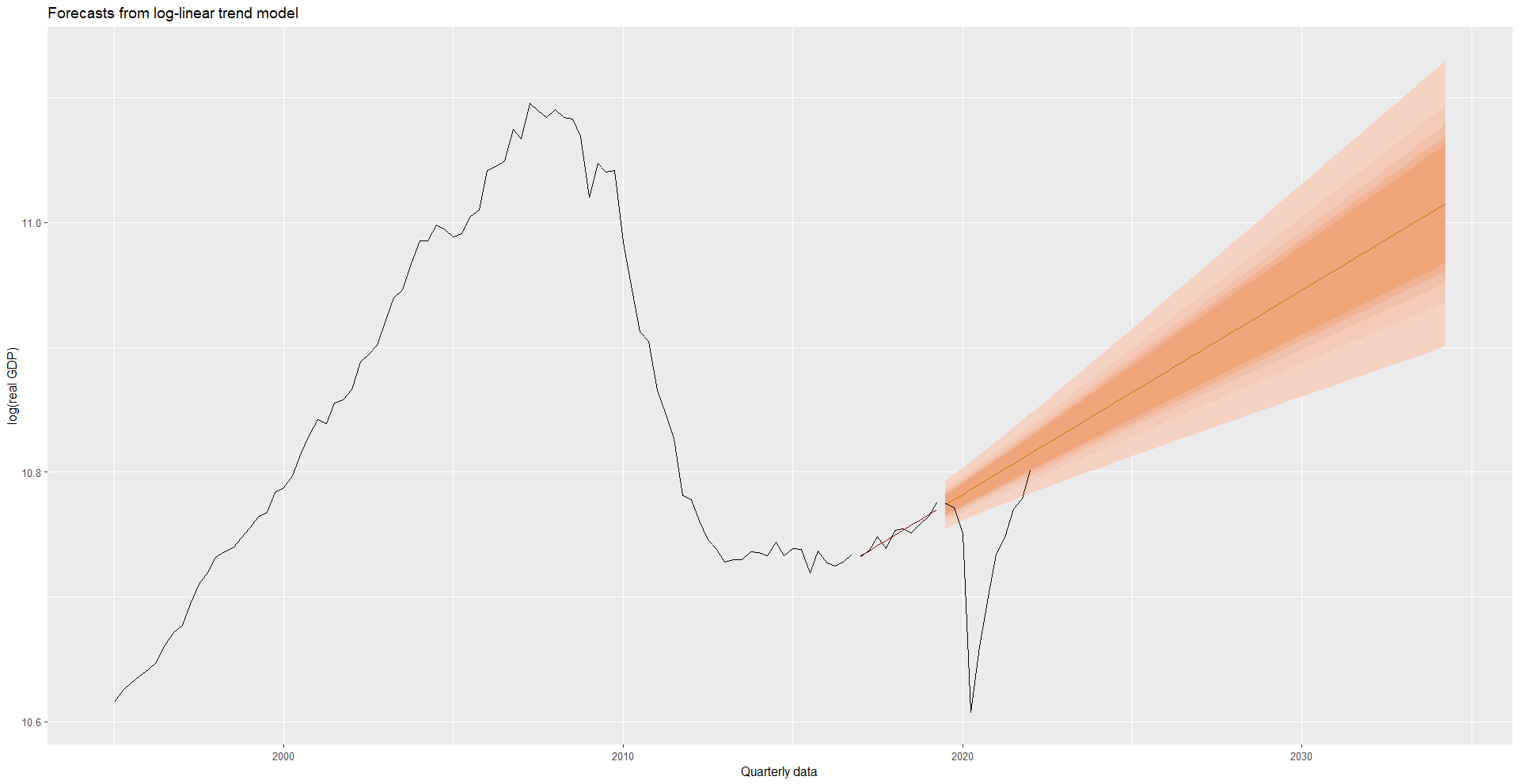

(A) Introduction – software, databases, time series, business cycles

(B) Stationarity/Non-stationarity: Vector AutoRegressive models (VAR models), Vector Error Correction models (VEC models)

(C) Structural Vector AutoRegressive models (SVAR)

c1. Impulse response function

c2. Forecast error variance decomposition

c3. Historical decomposition

c4. Identification strategies

c41. Zero Short-Run restrictions

c42. Zero Long-Run restrictions

c43. Medium Run restrictions

c44. Sign Restrictions

c45. Testing Invertibility

c46. External Instruments

(D) Applied Panel methods

(E) High-dimensional datasets. Factor models.

Readings

(A) Detailed notes and notes on forecasting. Also

Owyang, Michael and Sekhposyan, Tatevik, (2012), Okun’s law over the business cycle: was the great recession all that different?, Federal Bank of St. Louis Review, issue Sep, p. 399-418.

(B)

Stock, J.H. Watson, M.W. (2001). Vector Autoregressions. Journal of Economic Perspectives

Stock, J., and Watson M (2012): Disentangling the Channels of the 2007-2009 Recession. Brookings Papers on Economic Activity

Lettau, M., & Ludvigson, S., (2004). Understanding Trend and Cycle in Asset Values Reevaluating the Wealth Effect on Consumption. American Economic Review

Lettau, M., & Ludvigson, S., (2004). Expected returns and expected dividend growth – Journal of Financial Economics

Lettau, M., & Ludvigson, S., (2001). Consumption Aggregate Wealth and Expected Stock Returns – Journal of Finance

(C)

The SVAR addon for gretl (detailed pdf file on SVAR applications)

Lawrence H. Summers (1991). The Scientific Illusion in Empirical Macroeconomics. The Scandinavian Journal of Economics 93(2), pp. 129-148. url: http://www.jstor.org/stable/3440321

Paul Romer (2016). The Trouble With Macroeconomics. https://paulromer.net/trouble-with-macroeconomics-update/WP-Trouble.pdf and https://paulromer.net/trouble-with-macroeconomics-update/

Also https://paulromer.net/archive/

Identification

V.A. Ramey (2016). Chapter 2 – Macroeconomic Shocks and Their Propagation. In: ed. by John B. Taylor and Harald Uhlig. Vol. 2. Handbook of Macroeconomics. Elsevier, pp. 71-162. http://www.sciencedirect.com/science/article/pii/S1574004816000045 (sections 1 and 2 only)

Emi Nakamura and Jon Steinsson (2018). Identification in Macroeconomics. Journal of Economic Perspectives 32(3), pp. 59-86. http://www.aeaweb.org/articles?id=10.1257/jep.32.3.59

https://www.aeaweb.org/articles?id=10.1257/jep.32.3.59

James H. Stock and Mark W. Watson (2018). Identication and Estimation of Dynamic Causal Effects in Macroeconomics Using External Instruments. The Economic Journal 128(610), pp. 917-948. https://onlinelibrary.wiley.com/doi/abs/10.1111/ecoj.12593

Identification – Narrative approach

Christina D. Romer and David H. Romer (2010). The Macroeconomic Effects of Tax Changes: Estimates Based on a New Measure of Fiscal Shocks. American Economic Review 100(3), pp. 763-801. http://www.aeaweb.org/articles.php?doi=10.1257/aer.100.3.763

Valerie A. Ramey (2011). Identifying Government Spending Shocks: It’s all in the Timing. The Quarterly Journal of Economics 126(1), pp. 1{50. url: http://qje.oxfordjournals.org/content/126/1/1

(D)

Ilzetzki, Ethan & Mendoza, Enrique G. & Végh, Carlos A., 2013. “How big (small?) are fiscal multipliers?,” Journal of Monetary Economics, Elsevier, vol. 60(2), pages 239-254.

(E)

Michael W. McCracken and Serena Ng (2016). FRED-MD: A Monthly Database for Macroeconomic Research. pp. 574-589 https://doi.org/10.1080/07350015.2015.1086655

https://research.stlouisfed.org/wp/more/2015-012

Teaching Activities

Lectures (4 hours per week) and Laboratory Exercises (1 hour per week)

Teaching Organization

Assessment

Language of evaluation: Greek/English

Class Participation: 10%

Problem sets. Various problem sets during the course (multiple choice questionnaires, short-answer questions, open-ended questions) and short presentations of projects (problem solving, written work, essay/report, public presentation): 20%

Mid-term exam: 25%, (multiple choice questionnaire, short-answer questions, 2 hours)

Final Exam: 45%, 2 hours

Total: 100%

All evaluation criteria are known to the students. Published at http://postgrad.econ.upatras.gr/en/msc/courses/applied-macro-econometrics

Use of ICT

Use of Information and Communication Technologies (ICTs) in teaching (computer based lecture presentations, internet use, videos, databases search). Direct use in class and homework of econometrics software gretl and use of R. All teaching material is uploaded on the e-class platform, which the enrolled students can freely download.