Εφαρμοσμένη Μακρο-οικονομετρία

Κωδικός Μαθήματος

Εξάμηνο: 1ο

Έτος Σπουδών: 1ο έτος

Κατηγορία: Υποχρεωτικό

Προς Φοιτητές Erasmus: Όχι

Μαθησιακά Αποτελέσματα

Με την επιτυχή ολοκλήρωση του μαθήματος οι φοιτητές/τριες θα είναι σε θέση να:

- κατανοούν ορισμένες από τις δυσκολίες, τα προβλήματα και τις λύσεις που προκύπτουν στην εφαρμοσμένη μακροοικονομική εργασία

- προβούν σε κριτική αξιολόγηση της εφαρμοσμένης μακροοικονομικής έρευνας

- είναι εξοικειωμένοι με τις κύριες προσεγγίσεις στην υποδειγματοποίηση μακροοικονομικών δεδομένων

- κατανοούν τις τυπικές και πρακτικές πτυχές σημαντικών μακροοικονομετρικών μεθόδων.

- εφαρμόζουν αναλυτικές μεθόδους και να αναγνωρίζουν τους περιορισμούς τους, επιλύουν προβλήματα που σχετίζονται με την ταυτοποίηση χρησιμοποιώντας μακροοικονομικά δεδομένα

- είναι σε θέση να αναφέρουν αποτελέσματα εμπειρικών ερευνών που αποκτήθηκαν χρησιμοποιώντας τις καλυπτόμενες μεθόδους.

- να εκτελέσουν αναλύσεις με μακροοικονομικά δεδομένα χρησιμοποιώντας gretl και R και να ερμηνεύσουν αποτελέσματα από το gretl καθώς και την R

- να είναι σε θέση να αναπαράγουν και να παρουσιάσουν μακροοικονομικές ερευνητικές εργασίες κάτι που θα ενισχύσει την ικανότητά τους να γράψουν μια υψηλής ποιότητας διπλωματική εργασία

Περιεχόμενα μαθήματος

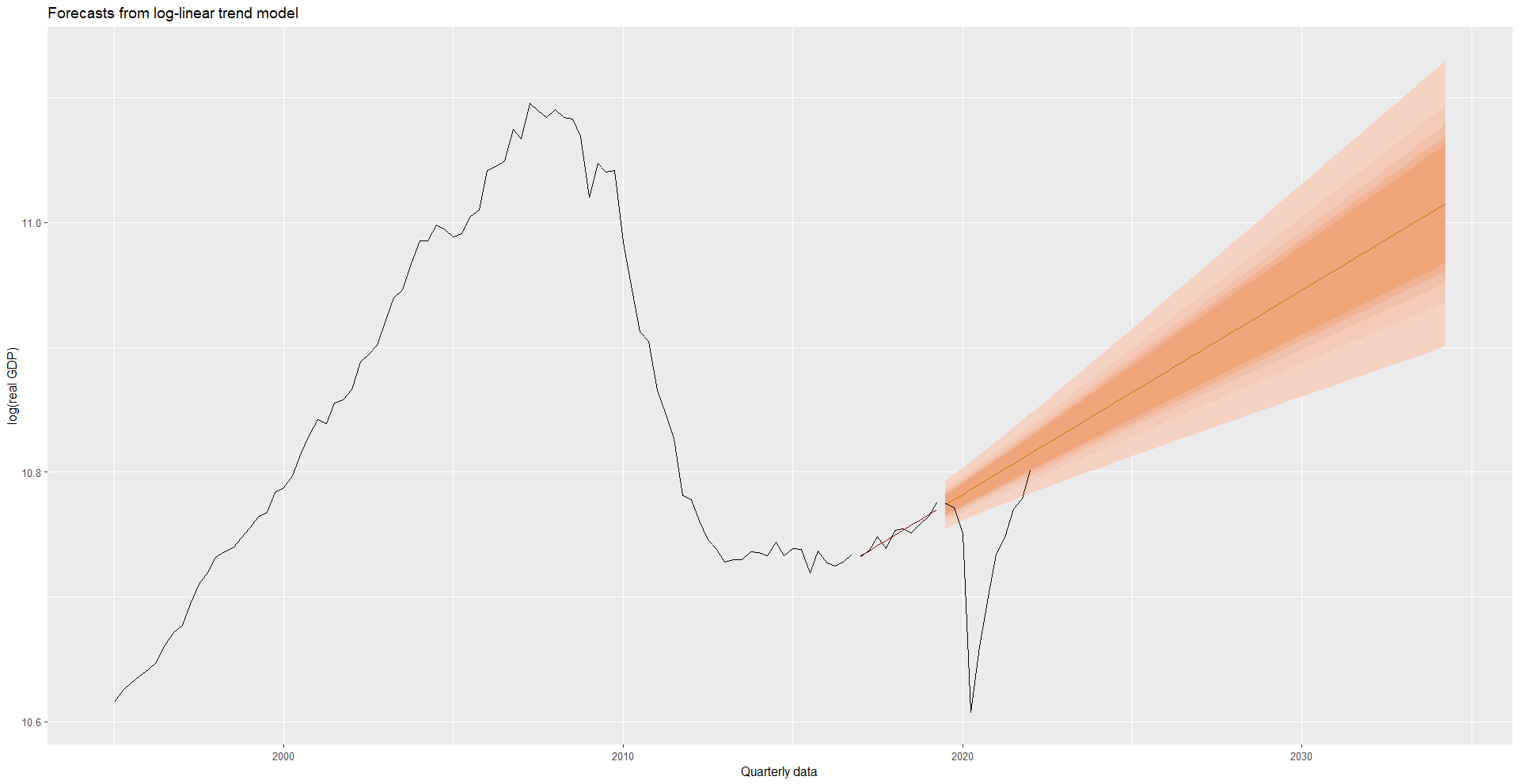

(A) Introduction – software, databases, time series, business cycles

(B) Stationarity/Non-stationarity: Vector AutoRegressive models (VAR models), Vector Error Correction models (VEC models)

(C) Structural Vector AutoRegressive models (SVAR)

c1. Impulse response function

c2. Forecast error variance decomposition

c3. Historical decomposition

c4. Identification strategies

c41. Zero Short-Run restrictions

c42. Zero Long-Run restrictions

c43. Medium Run restrictions

c44. Sign Restrictions

c45. Testing Invertibility

c46. External Instruments

(D) Applied Panel methods

(E) High-dimensional datasets. Factor models.

Readings

(A) Detailed notes and notes on forecasting. Also

Owyang, Michael and Sekhposyan, Tatevik, (2012), Okun’s law over the business cycle: was the great recession all that different?, Federal Bank of St. Louis Review, issue Sep, p. 399-418.

(B)

Stock, J.H. Watson, M.W. (2001). Vector Autoregressions. Journal of Economic Perspectives

Stock, J., and Watson M (2012): Disentangling the Channels of the 2007-2009 Recession. Brookings Papers on Economic Activity

Lettau, M., & Ludvigson, S., (2004). Understanding Trend and Cycle in Asset Values Reevaluating the Wealth Effect on Consumption. American Economic Review

Lettau, M., & Ludvigson, S., (2004). Expected returns and expected dividend growth – Journal of Financial Economics

Lettau, M., & Ludvigson, S., (2001). Consumption Aggregate Wealth and Expected Stock Returns – Journal of Finance

(C)

The SVAR addon for gretl (detailed pdf file on SVAR applications)

Lawrence H. Summers (1991). The Scientific Illusion in Empirical Macroeconomics. The Scandinavian Journal of Economics 93(2), pp. 129-148. url: http://www.jstor.org/stable/3440321

Paul Romer (2016). The Trouble With Macroeconomics. https://paulromer.net/trouble-with-macroeconomics-update/WP-Trouble.pdf and https://paulromer.net/trouble-with-macroeconomics-update/

Also https://paulromer.net/archive/

Identification

V.A. Ramey (2016). Chapter 2 – Macroeconomic Shocks and Their Propagation. In: ed. by John B. Taylor and Harald Uhlig. Vol. 2. Handbook of Macroeconomics. Elsevier, pp. 71-162. http://www.sciencedirect.com/science/article/pii/S1574004816000045 (sections 1 and 2 only)

Emi Nakamura and Jon Steinsson (2018). Identification in Macroeconomics. Journal of Economic Perspectives 32(3), pp. 59-86. http://www.aeaweb.org/articles?id=10.1257/jep.32.3.59

https://www.aeaweb.org/articles?id=10.1257/jep.32.3.59

James H. Stock and Mark W. Watson (2018). Identication and Estimation of Dynamic Causal Effects in Macroeconomics Using External Instruments. The Economic Journal 128(610), pp. 917-948. https://onlinelibrary.wiley.com/doi/abs/10.1111/ecoj.12593

Identification – Narrative approach

Christina D. Romer and David H. Romer (2010). The Macroeconomic Effects of Tax Changes: Estimates Based on a New Measure of Fiscal Shocks. American Economic Review 100(3), pp. 763-801. http://www.aeaweb.org/articles.php?doi=10.1257/aer.100.3.763

Valerie A. Ramey (2011). Identifying Government Spending Shocks: It’s all in the Timing. The Quarterly Journal of Economics 126(1), pp. 1{50. url: http://qje.oxfordjournals.org/content/126/1/1

(D)

Ilzetzki, Ethan & Mendoza, Enrique G. & Végh, Carlos A., 2013. “How big (small?) are fiscal multipliers?,” Journal of Monetary Economics, Elsevier, vol. 60(2), pages 239-254.

(E)

Michael W. McCracken and Serena Ng (2016). FRED-MD: A Monthly Database for Macroeconomic Research. pp. 574-589 https://doi.org/10.1080/07350015.2015.1086655

https://research.stlouisfed.org/wp/more/2015-012

Διδακτικές Δραστηριότητες

Διαλέξεις (4 ώρες/εβδομάδα) και Εργαστηριακές Ασκήσεις (1 ώρα/εβδομάδα)

Οργάνωση Διδασκαλίας

| Δραστηριότητα | Φόρτος Εργασίας Εξαμήνου |

| Διαλέξεις | 52 |

| Εργαστηριακή Άσκηση | 20 |

| Μελέτη & ανάλυση βιβλιογραφίας | 70 |

| Διαδραστική διδασκαλία | 13 |

| Εκπόνηση μελέτης (project), Συγγραφή εργασίας / εργασιών | 45 |

| Σύνολο Μαθήματος

(25 ώρες φόρτου εργασίας ανά πιστωτική μονάδα) |

200 |

Αξιολόγηση

Γλώσσα Αξιολόγησης: Ελληνική/Αγγλική

Συμμετοχή στην τάξη: 10%

Σύνολα προβλημάτων. Διάφορα σύνολα προβλημάτων κατά τη διάρκεια του μαθήματος (ερωτηματολόγια πολλαπλών επιλογών, ερωτήσεις σύντομης απάντησης, ερωτήσεις ανάπτυξης) και σύντομες παρουσιάσεις εργασιών (επίλυση προβλημάτων, γραπτή εργασία, δημόσια παρουσίαση): 20%

Ενδιάμεση εξέταση: 25%, (ερωτηματολόγιο πολλαπλών επιλογών, ερωτήσεις σύντομης απάντησης, 2 ώρες)

Τελική εξέταση: 45%, 2 ώρες

Σύνολο: 100%

Όλα τα κριτήρια αξιολόγησης είναι γνωστά στους φοιτητές/τριες. Δημοσιεύονται από την αρχή του εξαμήνου στη διεύθυνση

http://postgrad.econ.upatras.gr/en/msc/courses/applied-macro-econometrics

Χρήση ΤΠΕ

Χρήση Τεχνολογιών Πληροφορικής και Επικοινωνιών (Τ.Π.Ε) στη διδασκαλία (παρουσιάσεις διαλέξεων με υπολογιστή, χρήση διαδικτύου, βίντεο, αναζήτηση βάσεων δεδομένων). Άμεση χρήση στην τάξη και στην εργασία στο σπίτι του λογισμικού οικονομετρίας gretl και χρήση του R. Όλο το διδακτικό υλικό βρίσκεται στην πλατφόρμα e-class, το οποίο οι εγγεγραμμένοι μαθητές μπορούν να κατεβάσουν ελεύθερα.

Προπτυχιακά

Τελευταία νέα & ανακοινώσεις

Σεμινάριο Problem Solving από την PwC

Σεμινάριο Problem Solving από την PwC για τους μεταπτυχιακούς φοιτητές του ΠΜΣ “Εφαρμοσμένη Οικονομική και Ανάλυση Δεδομένων”

Με ιδιαίτερη επιτυχία πραγματοποιήθηκε ένα εξαιρετικά ενδιαφέρον σεμινάριο Problem Solving από την εταιρεία PwC, αποκλειστικά για τους μεταπτυχιακούς φοιτητές του Προγράμματος Μεταπτυχιακών Σπουδών […]

Πιστοποίηση ΠΜΣ από Εθνική Αρχή Ανώτατης Εκπαίδευσης (ΕΘΑΑΕ)

Η Εθνική Αρχή Ανώτατης Εκπαίδευσης (ΕΘΑΑΕ) απένειμε στο Π.Μ.Σ. «Εφαρμοσμένη Οικονομική και Ανάλυση Δεδομένων» του Τμήματος Οικονομικών Επιστημών του Πανεπιστημίου Πατρών τη διαπίστευση του Προγράμματος Μεταπτυχιακών Σπουδών. Η διαπίστευση απονεμήθηκε κατόπιν των σχετικών διαδικασιών, διασφαλίζοντας τη […]

Πρόσκληση εκδήλωσης ενδιαφέροντος – Ακαδημαϊκό Έτος 2025-2026

4/9/2024: Πρόσκληση στην Ημέρα Ανοικτής Συζήτησης του ΠΜΣ

Σας προσκαλούμε στην Ημέρα Ανοικτής Συζήτησης που θα γίνει στο Τμήμα Οικονομικών Επιστημών για να συζητήσουμε με διδάσκοντες, μεταπτυχιακούς και αποφοίτους του ΠΜΣ «Εφαρμοσμένη Οικονομική και Ανάλυση Δεδομένων» για τις μεταπτυχιακές σπουδές στην περιοχή των οικονομικών.

Στοιχεία της εκδήλωσης:

Ημερομηνία: Τετάρτη, 4 Σεπτεμβρίου 2024

Ώρα: 14:00

Τοποθεσία: Αμφιθέατρο […]